Online Course Financial Foundations: Setting Your Price and Platform

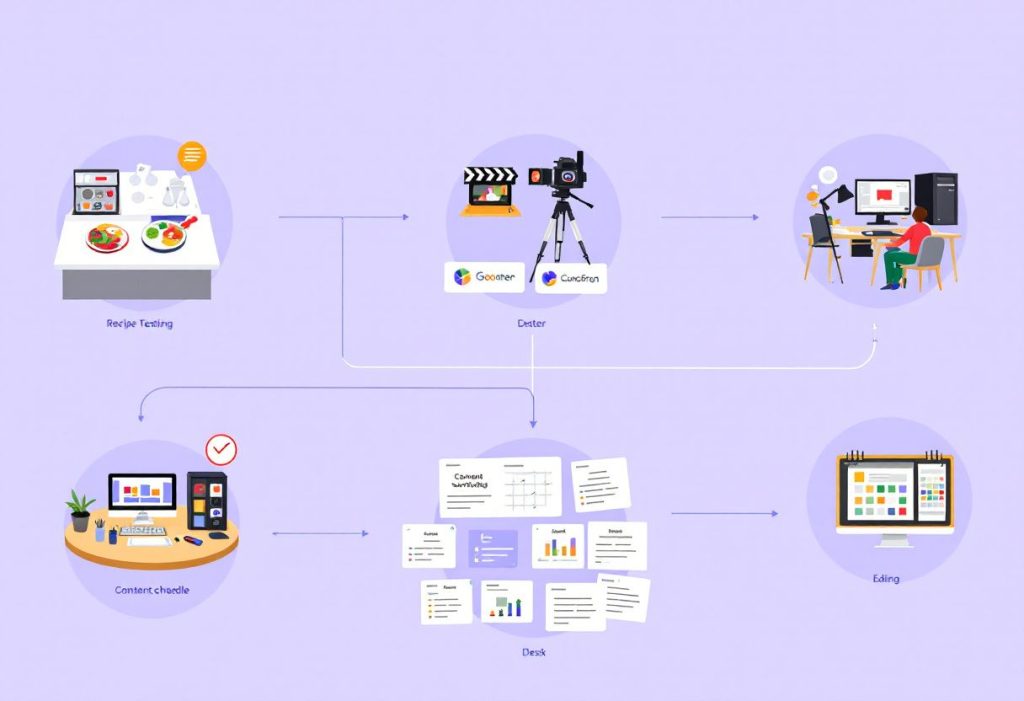

Understanding the Online Course Business Model

Creating and selling online courses requires a clear understanding of the unique financial dynamics involved in digital education. Unlike traditional businesses, online courses offer exceptional scalability with minimal incremental costs per student. However, initial investment in quality content creation and marketing can be substantial, making proper financial planning crucial for success.

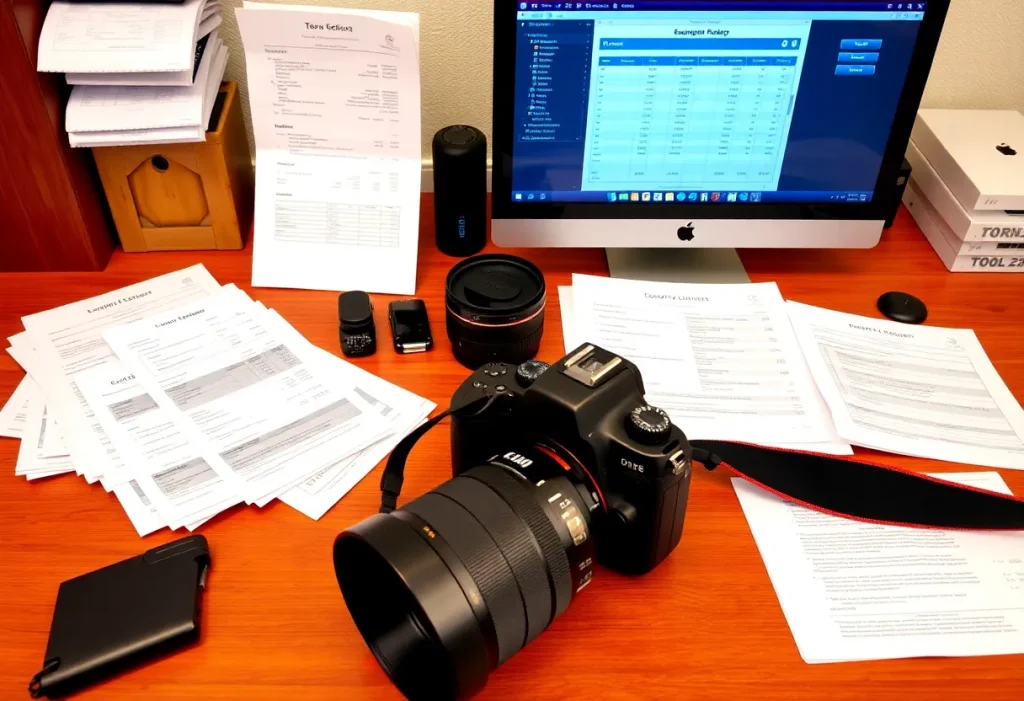

Initial Investment Requirements

The foundation of a successful online course business begins with quality content creation. Many course creators underestimate the initial investment needed to produce professional-level courses. Understanding these upfront costs helps in developing realistic pricing strategies and revenue projections.

Essential Equipment and Tools:

Production Equipment:

- Professional microphone: $200-500

- Camera/webcam: $300-800

- Lighting setup: $200-400

- Video editing software: $20-50/month

These investments form the technical foundation of your course creation infrastructure, ensuring professional-quality content that commands premium pricing.

Platform Economics and Selection

Choosing the right platform for hosting and selling your courses significantly impacts your financial success. Each platform offers different features, pricing structures, and market access opportunities. Understanding these differences helps optimize your revenue potential.

Popular platforms demonstrate varying economic models:

Teachable:

- Professional Plan: $119/month

- Transaction fees: 0%

- Payment processing: 2.9% + $0.30

- Instant payouts available

Thinkific:

- Pro Plan: $99/month

- Transaction fees: 0%

- Payment processing: 2.9% + $0.30

- Advanced course features included

Course Pricing Strategy Development

Developing an effective pricing strategy requires careful consideration of multiple factors. Your pricing should reflect your course’s value proposition while considering market dynamics and target audience capabilities.

Market Research and Positioning

Understanding your market position forms the foundation of effective pricing. Research similar courses in your niche, analyzing both their pricing and value propositions. Consider factors such as course depth, production quality, and included support when positioning your offering.

Value-Based Pricing Implementation

Value-based pricing focuses on the outcomes your course delivers rather than the cost of production. Consider the tangible benefits students receive from your course, such as increased earning potential, professional certification, or specific skill development.

Common price points for different course categories:

Entry-Level Courses:

- Mini-courses: $27-97

- Skill-specific tutorials: $97-197

- Foundation courses: $197-497

Advanced Courses:

- Comprehensive programs: $497-997

- Professional certification: $997-1,997

- Mastery programs: $1,997+

Revenue Projection Development

Creating realistic revenue projections helps guide business decisions and marketing investments. Base your projections on market research and platform-specific conversion rates while maintaining conservative estimates.

Consider these key factors in your revenue modeling:

- Market size and reach

- Conversion rates by traffic source

- Average purchase value

- Student completion rates

- Referral potential

Marketing Investment Planning

Marketing represents a significant ongoing investment in course business success. Develop a comprehensive marketing budget that supports sustainable growth while maintaining profitability.

Marketing Budget Allocation:

Content Marketing:

- Blog content development

- Social media presence

- Email marketing systems

- Community building

Paid Advertising:

- Platform-specific ads

- Social media campaigns

- Retargeting strategies

- Affiliate programs

Business Infrastructure Development

Establishing proper business infrastructure ensures efficient operations and scalability. Focus on creating systems that can handle growth while maintaining quality student experiences.

Essential Systems Development:

Your business requires robust systems for:

- Student enrollment management

- Content delivery optimization

- Customer support processes

- Financial tracking and reporting

- Performance analytics

Financial Goals and Metrics

Setting clear financial goals helps guide business decisions and measure success. Establish specific metrics for tracking progress and evaluating strategy effectiveness.

Key Performance Indicators:

Monitor these essential metrics:

- Student enrollment rates

- Average revenue per student

- Customer acquisition costs

- Completion rates

- Student satisfaction scores

Long-term Sustainability Planning

Building a sustainable course business requires attention to both immediate and long-term financial considerations. Focus on creating systems that support ongoing content updates, platform improvements, and market adaptation.

Consider implementing regular review processes for:

- Content freshness and relevance

- Platform performance

- Student feedback integration

- Market trend adaptation

- Technology updates

Remember that successful online course businesses require ongoing investment in both content quality and student experience. Focus on building sustainable systems while maintaining flexibility for market opportunities and technological advances.

Online Course Business Management: From Content to Cash Flow

Financial Operations Management

Managing the financial operations of an online course business requires attention to multiple revenue streams and payment systems. Understanding the flow of money through your business enables better decision-making and growth planning. Course creators must develop systems for tracking various income sources while maintaining clear financial records.

Revenue Stream Management

The complexity of managing course revenue increases with business growth. Most successful course creators generate income through multiple channels, each requiring specific management approaches. Understanding these revenue streams helps optimize business performance and identify growth opportunities.

Primary Revenue Categories:

Direct Course Sales:

- One-time purchases

- Payment plans

- Bundle offerings

- Early-bird pricing

- Launch specials

Recurring Revenue:

- Membership programs

- Coaching additions

- Update subscriptions

- Community access

- Support services

Payment Processing Systems

Implementing efficient payment processing systems significantly impacts business success. Course creators must balance convenience for students with business efficiency and cost management.

Payment Gateway Selection

Your payment gateway choice affects both conversion rates and operational efficiency. Consider these factors in your selection:

Customer Experience:

- Multiple payment options

- Mobile optimization

- Secure checkout process

- Clear communication

- Easy refund handling

Financial Analysis and Reporting

Developing comprehensive financial analysis systems helps track business health and identify optimization opportunities. Regular financial review processes ensure sustainable growth and profitability.

Essential Financial Reports:

Monthly Analysis:

- Revenue by course

- Student acquisition costs

- Refund rates

- Payment plan performance

- Marketing ROI

Student Success Metrics

Tracking student success metrics provides valuable insights for business improvement. These metrics often correlate directly with financial performance and customer satisfaction.

Key Success Indicators:

Course Completion Rates:

- Module progression

- Assignment submission

- Quiz performance

- Engagement levels

- Support utilization

Marketing Investment Management

Strategic marketing investment drives business growth while maintaining profitability. Creating systems for allocating and tracking marketing spend ensures efficient resource utilization.

Consider these primary marketing channels:

Digital Marketing Allocation:

- Content marketing

- Social media advertising

- Email campaigns

- Affiliate partnerships

- Influencer collaborations

Operational Systems Development

Efficient operational systems support sustainable business growth. Focus on creating scalable processes that maintain quality while reducing manual intervention.

Essential Operational Areas:

Your business requires robust systems for:

- Student onboarding

- Content delivery

- Support management

- Performance tracking

- Financial operations

Technology Integration Strategy

Implementing appropriate technology solutions enables efficient business operations. Select tools that integrate well while providing necessary functionality for growth.

Core Technology Stack:

Course Platform Integration:

- Learning management system

- Payment processing

- Email marketing

- Analytics tools

- Customer support

Performance Optimization

Regular performance review and optimization ensures continued business growth. Develop systems for monitoring and improving various business aspects.

Focus on these key areas:

Business Performance:

- Sales conversion rates

- Student satisfaction

- Content effectiveness

- Support efficiency

- Financial metrics

Resource Allocation Management

Effective resource allocation supports business growth while maintaining profitability. Create systems for managing various business resources efficiently.

Consider these resource categories:

Primary Resources:

- Time investment

- Financial allocation

- Team capacity

- Technology resources

- Content assets

Future Growth Planning

Planning for future growth requires careful consideration of various business aspects. Develop strategies that support sustainable expansion while maintaining quality.

Growth Considerations:

Strategic Planning:

- Market expansion

- Product development

- Team building

- Technology advancement

- Content scaling

Remember that successful course business management requires consistent attention to both operational details and strategic planning. Focus on building sustainable systems while maintaining flexibility for market opportunities.

Student Service Enhancement

Providing exceptional student service directly impacts business success. Develop comprehensive support systems that enhance the learning experience while maintaining operational efficiency.

Service Components:

Support Systems:

- Technical assistance

- Content clarification

- Progress monitoring

- Community management

- Success tracking

The implementation of these systems should focus on scalability while maintaining personal connection with students.

Online Course Empire Building: Scaling Your Education Business

Building Your Course Empire

Creating a scalable online education business requires strategic planning and systematic execution. Moving beyond single courses to build a comprehensive education empire demands attention to multiple growth factors while maintaining quality and student success rates.

Advanced Monetization Strategies

Developing sophisticated monetization approaches enables significant business growth. Successful course creators typically implement multiple revenue streams that complement their core offerings.

Premium Program Development

Creating high-ticket programs requires careful consideration of value delivery and market positioning. These programs often combine various elements to justify premium pricing:

Comprehensive Programs:

- Masterminds: $5,000-25,000/year

- Certification programs: $2,000-10,000

- Group coaching: $1,000-5,000/month

- VIP experiences: $10,000-50,000

International Market Expansion

Expanding into international markets presents significant growth opportunities. Understanding cultural differences and local market dynamics becomes crucial for successful expansion.

Market Entry Considerations:

Your expansion strategy should address:

- Content localization

- Payment systems

- Cultural adaptation

- Support requirements

- Legal compliance

Content Ecosystem Development

Building a comprehensive content ecosystem supports sustainable growth while creating multiple revenue opportunities. Focus on creating interconnected content that serves various student needs and learning preferences.

Strategic Content Development:

Begin with foundational courses and expand into specialized offerings. Create clear pathways for student progression while maintaining quality across all levels. Consider developing content in multiple formats to serve different learning styles and time constraints.

Advanced Business Systems

Implementing sophisticated business systems enables efficient scaling. These systems should support growth while maintaining quality and student satisfaction.

Essential System Components:

Operations Management:

- Automated enrollment

- Progress tracking

- Support ticketing

- Financial reporting

- Analytics dashboard

Team Building and Management

Growing your team strategically supports business scaling while maintaining quality. Focus on building teams that can handle increased complexity and student volume.

Key Roles for Scaling:

Core Team Development:

- Content creators

- Student success managers

- Marketing specialists

- Technical support

- Operations managers

Brand Development Strategy

Creating a strong education brand enables premium pricing and market leadership. Your brand should reflect excellence in education while maintaining authenticity and student focus.

Brand Elements:

Focus on developing:

- Unique teaching methodology

- Recognizable visual identity

- Consistent communication style

- Student success stories

- Industry authority

Technology Infrastructure

Implementing robust technology infrastructure supports efficient scaling. Select and integrate tools that provide necessary functionality while maintaining simplicity for students.

Essential Technology:

Your technology stack should include:

- Learning management system

- Marketing automation

- Analytics platforms

- Support systems

- Integration tools

Financial Scaling Strategy

Developing sophisticated financial strategies supports sustainable growth. Create systems for managing increased complexity while maintaining profitability.

Financial Considerations:

Strategic Planning:

- Investment allocation

- Revenue diversification

- Risk management

- Growth funding

- Profit optimization

Quality Control Systems

Maintaining quality during rapid growth requires systematic approaches. Implement comprehensive quality control measures across all business aspects.

Quality Management:

Focus Areas:

- Content standards

- Student experience

- Support quality

- Technical reliability

- Learning outcomes

Future Growth Planning

Creating clear plans for future growth helps guide current decisions while preparing for opportunities. Consider various growth pathways while maintaining flexibility for market changes.

Growth Pathways:

Consider expansion through:

- New market entry

- Product development

- Strategic partnerships

- Acquisition opportunities

- Innovation initiatives

Implementation Timeline

Develop clear timelines for implementing various scaling initiatives. Prioritize actions based on potential impact and resource requirements.

Strategic Implementation:

Phase 1 (Months 1-6):

- System optimization

- Team expansion

- Market testing

- Process refinement

Phase 2 (Months 7-12):

- Market expansion

- Product development

- Partnership building

- Advanced analytics implementation

Remember that successful scaling requires careful balance between growth ambition and operational capability. Focus on building sustainable systems while maintaining the quality that built your initial success.