Essential Insurance Coverage for Creative Professionals: Protecting Your Creative Business

Understanding Professional Insurance Needs

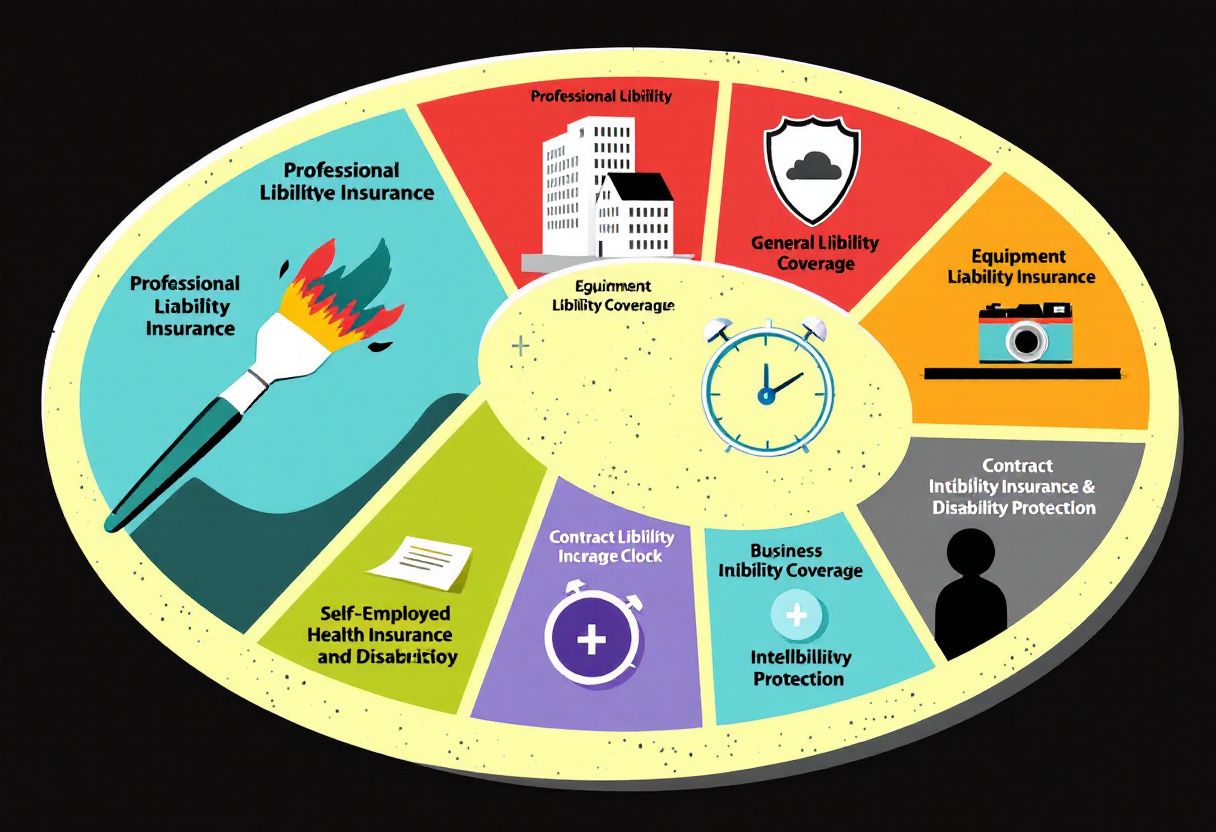

Core Coverage Types

Professional Liability Insurance (E&O)

Essential Coverage Levels:

- Freelancers: $500,000-1,000,000

- Small studios: $1,000,000-2,000,000

- Established agencies: $2,000,000-5,000,000

Annual Costs:

- Basic coverage: $500-800

- Standard coverage: $800-1,500

- Premium coverage: $1,500-3,000

What It Covers:

- Client disputes

- Project errors

- Missed deadlines

- Quality issues

- Professional mistakes

General Liability Insurance

Coverage Amounts:

- Minimum: $1,000,000 per occurrence

- Aggregate: $2,000,000

- Property damage: Included

- Medical payments: $5,000-10,000

Annual Costs:

- Home-based: $400-700

- Studio space: $700-1,200

- Multiple locations: $1,200-2,500

Protection Includes:

- Client injuries

- Property damage

- Legal defense

- Settlement costs

- Third-party claims

Equipment and Property Coverage

Business Property Insurance

Coverage Options:

- Basic Protection

- Equipment value: Up to $10,000

- Office contents: Included

- Basic theft protection

- Fire coverage

- Water damage

Cost: $300-500 annually

- Comprehensive Protection

- Equipment value: Up to $50,000

- All-risk coverage

- Worldwide protection

- Rental equipment

- Transportation coverage

Cost: $800-1,500 annually

Specialized Equipment Coverage

For Photographers:

- Camera bodies: Full replacement

- Lenses: Individual valuation

- Lighting equipment: Actual value

- Computers/storage: Included

- Accessories: Listed items

For Graphic Designers:

- Workstations: Full value

- Tablets/input devices: Listed

- Monitors: Actual cost

- Backup systems: Included

- Software recovery: Optional

Digital Asset Protection

Cyber Liability Insurance

Basic Coverage

Essential Protection:

- Data breach: $100,000

- Cyber attacks: $250,000

- Client data: Included

- Recovery costs: Covered

- Legal expenses: Included

Annual Cost: $500-1,000

Advanced Coverage

Enhanced Protection:

- Data breach: $1,000,000

- Cyber attacks: $2,000,000

- Business interruption

- Reputation management

- Client notifications

Annual Cost: $1,500-3,000

Business Interruption Insurance

Coverage Components

- Income Protection

- Lost revenue coverage

- Ongoing expenses

- Employee salaries

- Temporary location

- Recovery period

- Extra Expense Coverage

- Emergency equipment

- Temporary workspace

- Data recovery

- Client communication

- Business restoration

Client Project Protection

Contract Liability Coverage

Project Insurance

Coverage Options:

- Per-Project Basis

- Project value protection

- Client requirements

- Subcontractor coverage

- Timeline protection

- Deliverable guarantee

- Annual Policy

- Multiple projects

- Ongoing coverage

- Client portfolio

- Scalable protection

- Contract compliance

Intellectual Property Protection

Copyright Insurance

Protection Includes:

- Infringement defense

- Legal costs

- Settlement coverage

- Registration fees

- Portfolio protection

Annual Cost: $1,000-2,500

Healthcare Considerations

Self-Employed Health Insurance

Individual Coverage

Basic Plan:

- High deductible: $5,000-7,000

- Monthly premium: $300-500

- Preventive care: Covered

- Prescription plan: Basic

- Network restrictions: Yes

Premium Plan:

- Lower deductible: $2,000-3,000

- Monthly premium: $500-800

- Comprehensive coverage

- Better prescription plan

- Wider network

Disability Insurance

Income Protection

Short-term Coverage:

- Monthly benefit: 60-70% income

- Waiting period: 14-30 days

- Benefit period: 3-6 months

- Cost: $30-50/month

Long-term Coverage:

- Monthly benefit: 60-70% income

- Waiting period: 90 days

- Benefit period: To age 65

- Cost: $100-200/month

Implementation Strategy

Insurance Audit Checklist

Priority Assessment

- Immediate Needs

- Professional liability

- Equipment coverage

- Health insurance

- Basic liability

- Secondary Coverage

- Cyber insurance

- Business interruption

- Contract protection

- Extended coverage

Provider Selection

Evaluation Criteria

Key Factors:

- Financial Strength

- A.M. Best rating

- Market reputation

- Claim history

- Financial stability

- Industry Experience

- Creative business focus

- Client portfolio

- Specialization

- Support services

Risk Management and Claims Strategy for Creative Professionals

Risk Assessment Framework

Project Risk Evaluation

Client Project Risks

- Contract Issues

- Scope changes: High risk

- Payment delays: Medium risk

- Project cancellation: Medium risk

- Client disputes: High risk

- Timeline conflicts: Medium risk

- Deliverable Risks

- Quality disputes: High risk

- Technical failures: Medium risk

- Creative differences: High risk

- Format compatibility: Low risk

- Version control: Medium risk

Digital Asset Risks

Data Protection

- Work Files

- Local storage: Medium risk

- Cloud backup: Low risk

- External drives: Medium risk

- Client files: High risk

- Archive systems: Low risk

- Client Data

- Personal information: High risk

- Payment details: High risk

- Project specifics: Medium risk

- Communication records: Medium risk

- Access credentials: High risk

Documentation Systems

Project Documentation

Essential Records

- Client Communications

Project Documentation Template:

- Initial brief

- Change requests

- Approval records

- Timeline adjustments

- Delivery confirmations- Work Progress

Daily Log Template:

- Tasks completed

- Hours worked

- Client interactions

- Issues encountered

- Solutions implementedAsset Management

Digital Inventory

- Equipment Register

- Purchase date

- Serial numbers

- Value/depreciation

- Maintenance records

- Warranty information

- Software Licenses

- License numbers

- Renewal dates

- Version history

- Usage rights

- Access controls

Claims Management Process

Claim Preparation

Documentation Requirements

- Incident Reports

- Date and time

- Detailed description

- Parties involved

- Immediate actions

- Follow-up steps

- Supporting Evidence

- Client communications

- Contract documents

- Project timeline

- Financial records

- Witness statements

Claims Filing Procedure

Step-by-Step Process

- Initial Reporting

- 24-hour notification

- Basic information

- Policy numbers

- Contact details

- Incident summary

- Detailed Submission

- Complete documentation

- Evidence compilation

- Timeline creation

- Cost assessment

- Impact analysis

Emergency Response Plan

Business Continuity

Immediate Actions

- Equipment Failure

- Backup systems activation

- Client notification

- Emergency rentals

- Work rerouting

- Timeline adjustment

- Data Loss

- Backup restoration

- Client communication

- Project assessment

- Recovery timeline

- Prevention review

Crisis Communication

Client Management

- Communication Templates

Emergency Notice:

- Incident description

- Impact assessment

- Solution plan

- Timeline update

- Next steps- Status Updates

Progress Report:

- Actions taken

- Current status

- Expected resolution

- Client options

- Support contactsPrevention Strategies

Risk Mitigation

Project Safeguards

- Contract Protection

- Clear scope definition

- Change order process

- Payment milestones

- Dispute resolution

- Liability limits

- Quality Control

- Review processes

- Testing procedures

- Client approvals

- Version control

- Backup systems

Security Measures

Digital Protection

- Data Security

- Encryption protocols

- Access controls

- Regular backups

- Monitoring systems

- Update schedules

- Physical Security

- Equipment storage

- Studio security

- Transport protection

- Access restrictions

- Visitor protocols

Insurance Policy Management

Policy Review

Annual Assessment

- Coverage Review

- Policy limits

- Exclusions

- Deductibles

- Premium costs

- Additional needs

- Risk Updates

- Business changes

- Equipment values

- Client requirements

- Industry standards

- Market conditions

Claims History

Record Keeping

- Claim Tracking

Claim Log Template:

- Incident date

- Claim type

- Amount filed

- Resolution time

- Outcome details- Analysis

Annual Review:

- Claim patterns

- Risk indicators

- Prevention opportunities

- Policy adjustments

- Cost impactImplementation Checklist

Immediate Actions

- Documentation Setup

- Template creation

- File organization

- Backup systems

- Access protocols

- Update schedule

- Training Program

- Staff awareness

- Emergency procedures

- Documentation requirements

- Security protocols

- Client communication

Regular Maintenance

Monthly Tasks

- System Checks

- Backup verification

- Security updates

- Equipment inspection

- Document review

- Policy compliance

- Risk Assessment

- Project evaluation

- Client review

- Equipment status

- Security audit

- Policy updates

Advanced Protection Strategies and Future Planning for Creative Professionals

Business Growth Protection

Scaling Coverage Plans

Revenue-Based Protection

- Growth Stage Coverage

- Revenue $0-100K

- Basic liability: $1M

- Property: $25K

- E&O: $500K

Cost: $1,500-2,500/year - Revenue $100K-500K

- Extended liability: $2M

- Property: $100K

- E&O: $1M

Cost: $3,000-5,000/year - Revenue $500K+

- Comprehensive liability: $5M

- Property: $250K+

- E&O: $2M+

Cost: $7,000-12,000/year

- Team Coverage

- Solo practitioner

- Basic individual coverage

- Equipment protection

- Health insurance

Cost: $2,000-3,500/year - Small team (2-5)

- Group coverage options

- Expanded liability

- Multi-user equipment

Cost: $5,000-8,000/year - Agency level (6+)

- Full commercial coverage

- Employee benefits

- Multiple location protection

Cost: $12,000-20,000/year

International Protection

Global Operations Coverage

- International Projects

- Cross-border liability

- Currency protection

- Travel insurance

- Equipment transit

- Local regulations

- Foreign Market Entry

- Country-specific coverage

- Local partnerships

- Regulatory compliance

- Currency hedging

- Legal protection

Digital Asset Evolution

Future Technology Protection

Emerging Risks Coverage

- AI and Automation

- Algorithm errors

- Data bias

- Output liability

- Training data

- Integration issues

- Virtual/Augmented Reality

- Virtual property

- Digital assets

- User interaction

- Platform liability

- Content rights

Intellectual Property Future-Proofing

Digital Rights Management

- Content Protection

- Blockchain verification

- NFT considerations

- Smart contracts

- Rights tracking

- Usage monitoring

- Distribution Security

- Platform protection

- Streaming rights

- Download security

- Access control

- Version management

Advanced Client Protection

High-Value Project Insurance

Premium Coverage Options

- Large Project Protection

- Project value: $100K+

- Full completion guarantee

- Client satisfaction bond

- Timeline insurance

- Quality assurance

Cost: 2-5% of project value

- Enterprise Client Coverage

- Extended liability

- Performance bonds

- Milestone protection

- Reputation insurance

- Legal defense

Reputation Management

Brand Protection

- Crisis Coverage

- PR support: $10K-25K

- Media management

- Client communication

- Market recovery

- Brand rehabilitation

- Online Presence

- Digital reputation

- Review management

- Social media protection

- Content liability

- Platform security

Future-Focused Planning

Industry Evolution Coverage

Emerging Field Protection

- New Media Coverage

- Platform-specific risks

- Content evolution

- Format changes

- Technology shifts

- Market adaptations

- Hybrid Work Protection

- Remote operations

- Collaborative tools

- Virtual studios

- Cloud services

- Distributed teams

Sustainable Business Coverage

Long-term Protection

- Business Continuity

- Succession planning

- Portfolio protection

- Client transition

- Asset preservation

- Legacy management

- Market Adaptation

- Industry changes

- Technology shifts

- Client evolution

- Skill development

- Business model protection

Advanced Risk Management

Predictive Protection

Risk Analysis Tools

- Assessment Technology

- AI risk prediction

- Market analysis

- Trend monitoring

- Client behavior

- Industry patterns

- Prevention Systems

- Early warning

- Automated monitoring

- Threat detection

- Response protocols

- Recovery planning

Financial Security

Advanced Coverage Structure

- Layered Protection

- Primary coverage

- Excess liability

- Umbrella policies

- Specialized riders

- Custom endorsements

- Investment Protection

- Business assets

- Growth capital

- Revenue streams

- Market positions

- Future earnings

Implementation Framework

Strategic Integration

Development Timeline

- Short-term (6 months)

- Coverage assessment

- Risk evaluation

- System updates

- Team training

- Documentation

- Long-term (2-5 years)

- Market adaptation

- Technology integration

- Coverage evolution

- Business scaling

- Protection enhancement

Performance Metrics

Protection Assessment

- Coverage Efficiency

Quarterly Review:

- Claims ratio

- Premium efficiency

- Protection gaps

- Cost analysis

- Benefit utilization- Risk Management

Annual Assessment:

- Incident reduction

- Response time

- Recovery efficiency

- Cost savings

- Protection effectivenessFuture Considerations

Industry Trends

Emerging Needs

- Technology Integration

- Digital transformation

- AI implementation

- Platform evolution

- Tool advancement

- Process automation

- Market Changes

- Client expectations

- Service delivery

- Competition adaptation

- Value proposition

- Business models